Why no one wants to fund your mobile game startup

And what to do about it.

Join the 900+ founders, investors and operators who get these essays first.

Nothing gets venture capitalists more excited than a platform shift.

What is a platform shift? We could define it as follows: a new technology arrives that unlocks a novel consumer behavior. This sucks time and attention away from whatever people were doing before, and in the process creates a massive business opportunity for both the inventor of the technology and the ecosystem of companies that grows up around it.

Why do early-stage investors love them, and how do they play out in the games business?

Clean slate: What works on the new platform is often radically different from what worked on the old one. Many incumbent advantages in development and distribution are nullified, and new playbooks need to be written. This is fertile ground for startups.

Rising tide: Most VCs hate making content investments. With good reason! It is incredibly hard! But investing early in a platform shift allows all participants to benefit from the rising tide that comes from a constant influx of new users.

Blue ocean: As the tide rises, it reveals a beautiful blue ocean in which users are still cheap to acquire and there is plentiful design space to explore.

The biggest platform shift in history was, of course, the smartphone. It was new companies, not old ones, that were able to take advantage of it, and they created billions in enterprise value in the process.

Yesterday’s upstarts have become today’s incumbents: billion dollar businesses with entrenched competitive advantages. Their investments in development, user acquisition, live operations and other infrastructure combined with massive user bases acquired during less competitive times have created businesses with network effects, scale economies, brand and process power.

Not only has the blue ocean reddened, but developments such as Apple’s now-infamous ATT policy changes have tilted the playing field even further in favor of incumbents who built content fortresses during times when games were cheaper to make and users easier to acquire.

This does not mean new mobile game companies will not be launched or funded. But venture capital is the pursuit of outsized returns, and it increasingly looks like the odds of achieving them in mobile gaming today are much worse than they were at the start of the 2010s. More value will be created, but it is quite possible that the vast majority of it will be captured by companies like Scopely or MiHoYo, not a plucky band of startup rebels.

Now that the generalists have left the building, early stage mobile games investing is now largely the province of angels and specialist VCs with (hopefully!) deep domain expertise. But these investors know better than most how hard it is for new studios to achieve escape velocity in the current environment.

The default is “no”

All of this means that if you are raising for a mobile game company in 2023, the default position of most investors you talk to will be deep scepticism.

Here are a couple of things I sometimes hear in pitches, and why I don’t find them very convincing.

“We have an amazing team who worked at X, Y and Z Big Mobile Game company.”

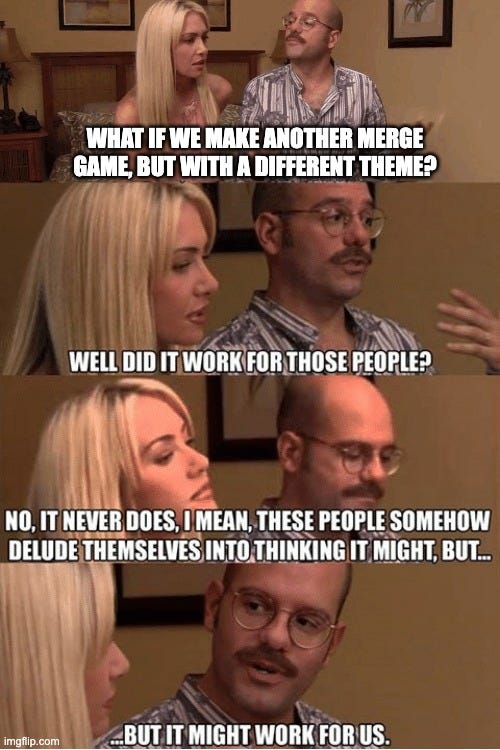

I hate to break it to you, but everyone we talk to has this. As Warren Buffett might say if he worked in mobile games: “When a game developer with a reputation for brilliance tackles a business with a reputation for bad economics, the reputation of the business remains intact.”“We have identified a design/thematic/metagame tweak to make in this genre that already has 3 dominant titles and 1000 dead competitors”.

Look, you might be right. It might work! Do I like my odds of guessing whether you are or not based on your pitch deck? No, I do not.

What to do about it

The only way to change this view is to convince whoever you are talking to that you are playing a fundamentally different game than the LTV>CPI playbook that was written in the 2010s.

This will mean different things to different investors, but to me it boils down to this:

A truly novel product with a differentiated distribution strategy.

Outlier outcomes are unlikely to come from doing the same thing as before, so you might as well do something completely different. The likelihood of failure is still high - but you might find it easier to get investors excited about making a bet and joining the journey with you.

Finally - maybe don’t make a game? Experienced game developers are incredible product builders because they know how to build complex software that is easy and pleasurable to use. They are also experts in acquiring and retaining users for digital products. These are incredible valuable skills, and they can be applied across many domains.

Chris Dixon once said that “the next big thing will start out looking like a toy”. I would contend that the next big thing will feel like a game, and there’s a good chance someone who knows games will build it.

If this sounds like something you’re working on, we’d like to hear from you.

David Kaye is co-founder and General Partner at F4 Fund. If you are raising for a pre-seed or seed-stage games or technology company, please reach out. Getting an intro from a founder we know is best, but a well-written cold email works too.

I'm tempted to send this with just about every random mobile pitch someone wants to send me!

Honestly, some of the impetus needs to shift from outsized returns to artistic merit, and sure, projects might have lower ROI, but at least something of value will be added to the world.