What Superhuman's exit tells us about venture math and the power of distribution

First things first - I'm a huge fan of Superhuman and I don’t think this exit was a bad outcome.

But one detail from today’s announcement of their acquisition by Grammarly jumped out at me: after a decade of building and raising over $100M (most recently at a near-unicorn valuation), Superhuman had "tens of thousands" of users.

There’s a story here about venture math, distribution, and timing that every founder should understand.

Luxury product meets venture math

Superhuman has always been something of a luxury product, charging ~$30/month for something most people get for free. Even with tens of thousands of users, that's a decent business - $35M in annual revenue at time of acquisition, although perhaps only marginally profitable with ~200 mostly US-based employees.

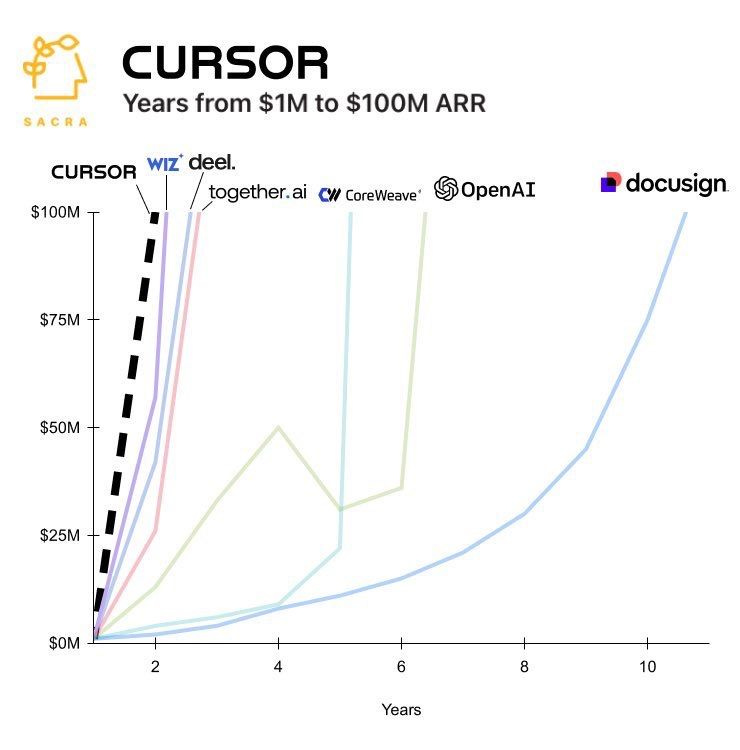

Here's the problem: that's just not the scale of growth that gets mega-fund VCs excited, especially at a time when the fastest growing AI companies are measuring “time to $100M ARR” in months, not years.

Superhuman is one of many startups that raised at rich valuations during ZIRP, which in hindsight may have reduced their optionality. But there’s also perhaps something to be said about product vs distribution.

Distribution always wins

The real story here is the user count disparity: Grammarly's tens of millions versus Superhuman's tens of thousands.

Distribution trumps product. This has always been true, but it's going to become even more true in the age of AI, where features can be duplicated with alarming speed. A great AI writing assistant? Every email client will have that within 12 months. Keyboard shortcuts and workflow optimization? Table stakes.

What can't be easily duplicated is access to millions of users who trust your brand and use your product daily. Grammarly has that. Superhuman, for all its product excellence, remained a high margin but niche product.

AI-native innovator’s dilemma

Superhuman also faces the classic innovator's dilemma as AI reshapes email. They've built an incredible product, but it's still fundamentally an email client rooted in pre-AI UX paradigms.

Look at their design choices: many of Superhuman's keyboard shortcuts deliberately mirror Gmail's. That was smart when competing with Gmail, but it's baggage when competing with AI-native clients like Net that can start fresh.

Superhuman’s value to Grammarly

Grammarly already has desktop and mobile writing apps - they're not just a browser plugin anymore. But email is where working professionals actually live, spending multiple hours of their workday reading, writing, and managing communications.

Grammarly wants to be the AI-native productivity suite that helps you communicate across every medium. Email is a huge part of that puzzle, and Superhuman gives them a premium entry point.

The more customer touchpoints you own, the more context you can gather. The more context you have, the better your AI becomes. And the better your AI becomes, the stronger your personalization moat.

What this means for founders

A few takeaways:

Venture math is unforgiving. If you take big checks at big valuations, you're committing to building a business that can support those numbers. There's no shame in the boutique business model, but be honest about what you're signing up for.

Distribution beats everything. In a world where AI can replicate features quickly, your sustainable advantage comes from access to users, not cleverness of implementation. Plan your distribution strategy before you plan your product roadmap.

Context is the new moat. In an AI world, sustainable advantage comes from proprietary data loops and user touchpoints, not feature differentiation.

Superhuman's exit is well-timed. They built a good business and found the right acquirer at the right moment. But it's also a reminder that in venture-backed startups, being good enough isn't enough. You need to be massively scalable, or you need to find someone who is.